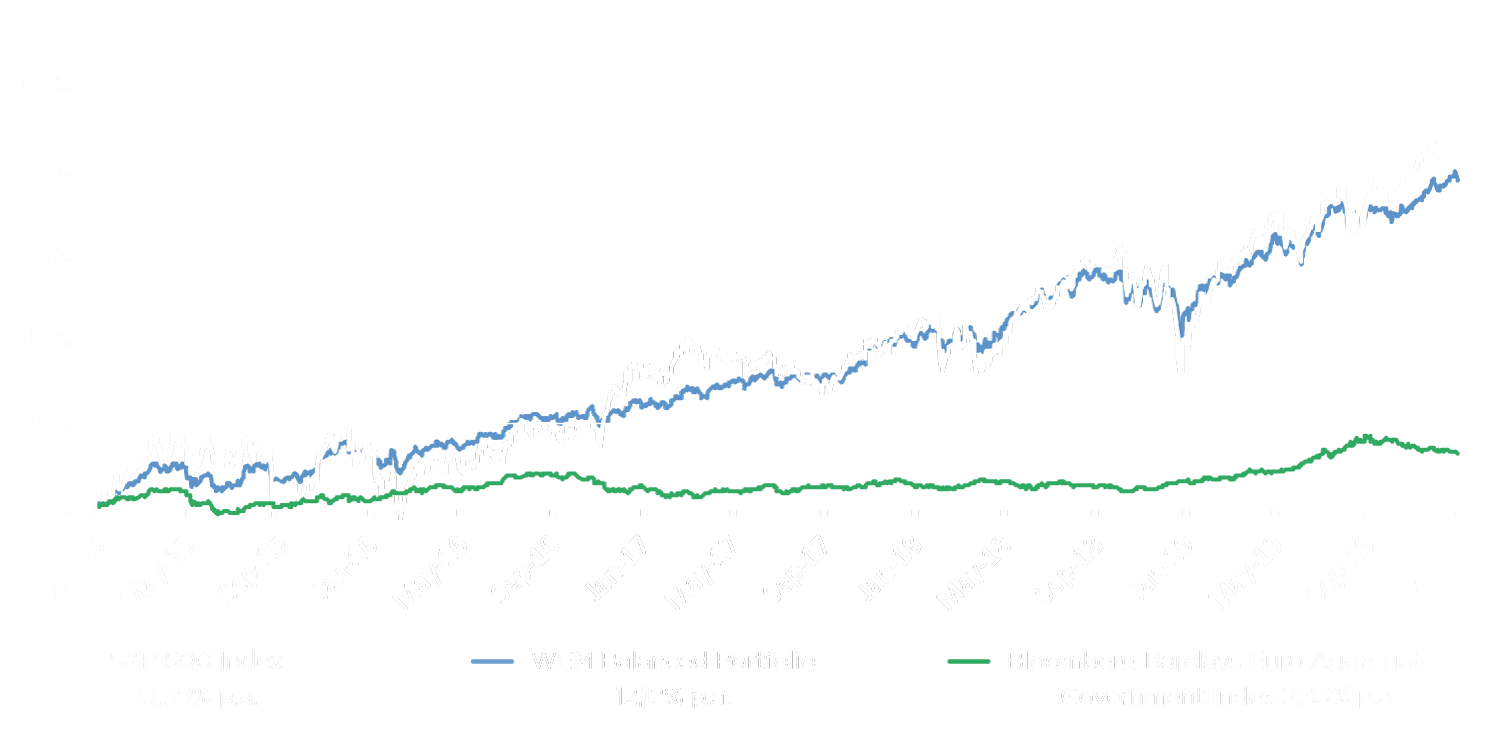

WEM Balanced’s actively managed portfolio enables clients to invest in TOP US equity stocks while optimizing risk by investing in high-quality european government bonds. The objective of the portfolio is to provide the client with a return on a regular basis that corresponds to the risk profile of the investment, ie. maximize return to an extent that is consistent with retaining the value of capital and maintaining the high liquidity of realized investments.

The appropriate combination of bonds and stock titles in the portfolio brings so-called diversification effect in the form of risk elimination with relative retention of yield.